So far, the number of cryptocurrency platforms flooding the market is overwhelming. Therefore it can be a nerve-wracking experience when looking for a platform that works best for you. To settle for a cryptocurrency platform, you need to be well informed. Trading and investing in crypto is an obvious risk. But by working with the best platforms, you might reduce the risk to a huge extent. So before you dive right in, take your time to know more about the crypto platform. Before we get into the best cryptocurrency platforms, let’s first go through the factors used to evaluate these platforms.

Evaluation Criteria

1. Cryptocurrencies supported

Are you looking for a platform with diversified crypto to invest and trade on? Then you need to know the cryptocurrencies the platform provides: either Ether, Bitcoin, Dogecoin, Ripple, or Litecoin. The more cryptocurrencies, the more diversified your portfolio is likely to be. And not just for digital currency but also fiat currency and other financial assets.

2. Mandatory fees

Like a bank, crypto platforms will often make money from exchange rates. So expect to pay some fees to keep your investment or trade going. These fees include inactivity fees, withdrawals, deposits, and even CFD trading fees. Additionally, some platforms charge fees for any transaction made on the platform.

3. Security measures

A cryptocurrency platform can’t be the best without following crucial security measures. Security measures like data privacy and fund security. Great cryptocurrency platforms and exchanges are well known for their reputable security measures. These platforms are much aware of the sheer insecurity posed by attackers. And that’s why they work overtime to prevent any case of attacks and thefts.

4. Customer support

We certainly can’t talk about the best crypto platforms without looking into their customer support. The best platforms have the best customer support that provides outstanding services to their users. These support services can be transactional, technical, or even a general crypto issue. Most of the platforms we reviewed provide you with an email or even a chatbot for customer support.

5. Methods of withdrawal and deposit

The platforms should provide the most available transaction methods for transactions. Nowadays, bank transfers and debit/credit cards are slowly getting outdated. Therefore most crypto platforms have embraced digital methods of transactions. The platforms discussed below allow popular digital transaction methods. Transaction methods like eWallets, PayPal, Venmo, Neteller, Skrill, or even CashApp.

6. User Experience

Another equally important factor is the user experience of a platform. Often, this is an overlooked factor and often seen as unnecessary. However, a well-designed and easy-to-use platform, without a doubt, sets the right mode for your trading sessions. And it doesn’t only go for the desktop interface but also for mobile apps. So following the above criteria, let’s get down to the best cryptocurrency platforms you should look into.

Coinbase

There is a reason why Coinbase is number one on our list. It remains the oldest cryptocurrency platform in the market after launching in 2012. And in 2021, it went public on Nasdaq. At the same time, this platform provides you with over 50 cryptos for your trading experience. More importantly, it comes packed with a free wallet with private keys to secure your crypto storage. Coinbase is well known for its above-average transaction fees. You’ll incur both a Coinbase fee and a spread fee when making transactions. And what is a spread fee? It’s the difference between the crypto’s costs and the amount you pay to receive it. Furthermore, the Coinbase fee can vary depending on your location. And if your transaction is between different crypto, you incur no Coinbase fees. Additional truncations include those of withdrawals and funding your account via various methods.

Security

The transaction fees of Coinbase might be an ultimate turn-off. But its security makes it one of the most secure cryptocurrency platforms. Its transparency on security is on another level. It’s said to use cold storage wallets for 98% of the crypto. And the rest of the 2% helps carry out trading activities. Even better, Coinbase provides an insurance policy for protecting your crypto. But this doesn’t guarantee total compensation in case of an attack.

StormGain

There is so much to like and digest about StormGain in one go. It has many programs that anyone doing anything crypto will find something useful. Starting with the most obvious, the process to register is simple with the web interface or Android and iOS applications. Next, you will need at least 10 Tethers to begin trading with StromGain. However, you can install the smartphone application and start StormGain’s Bitcoin mining to have the minimum amount in a few weeks. Besides, you can participate in crypto staking without freezing the funds for any specified period. Crypto deposits are free, while withdrawals are charged based on the asset. However, debit/credit purchases are levied a 5% commission as of this writing. Still, you should check the fees section for a complete picture of trading charges.

Security First and foremost, StormGain mandates a strong password. Next, two-factor authentication and AES-256-bit encryption mean the data stays secure. Users can also deploy multi-signature withdrawals for added deposit protection. In addition, StormGain undergoes quarterly security audits and has protocols for physical access monitoring to its premises. StormGain funds are stored in cold and hot wallets, with no specified percentage mentioned in the security section.

Gemini

Being launched in 2015, Gemini is an easy platform to navigate and work with. That’s why it remains a go-to platform for both active traders and beginner investors. It offers you more than 50 cryptocurrencies to trade and invest in. While transacting on Gemini, you’ll incur both a transaction fee and a convenience fee.

Security

Gemini embraces the offline method of crypto storage. It stores most of the cryptocurrency in cold wallets. And with only a small percentage stored in hot wallets to facilitate withdrawal demands.

OKX

OKX is a front-runner crypto exchange functional in over 100 countries. At its core, OKX is more than just an average platform to buy and sell crypto. In envelopes NFTs, DApps, DeFi, crypto trading, and most of the web 3.0 in its gigantic portfolio. You get buying options with cards and can avail of peer-to-peer trading. Besides, OKX features excellent earning options via staking, stablecoins, and some unique schemes like its dual investment, flash deals, etc., to make the most out of your idle funds. Moreover, you can also borrow 20 crypto assets while paying back in flexible terms. OKX also has a native crypto wallet, a crypto mining pool, and a homegrown token (OKB).

Security

OKX has decent security protocols, ensuring the safety of users’ crypto assets. First, you register a mobile number that alerts you of logins, withdrawals, password changes, etc. Next, OKX is compatible with 2-factor authentication via apps like Google authenticator. Besides, you can set a code to be included in all OKX emails as an anti-phishing measure.

Etoro

Founded in 2007, it remains one of the great platforms in the crypto market. Firstly, it’s open to over 140 countries, thus attracting over 20 million investors and traders worldwide. And secondly, it not only provides users with crypto but also additional assets. Assets include commodities and even stocks. If you’re a beginner crypto investor or trader, then you might want to give Etoro a try. It comes with a virtue portfolio, a feature that helps you practice, grow, and track your progress. It has a minimum deposit which might vary depending on the country. In Etoro, you only pay withdrawal fees and spread fees. Spread fees depend on the crypto being transacted.

Security

Etoro uses cold and hot wallets for crypto storage like any other cryptocurrency platform. And in the case of any fiat currency–mainly U.S dollars- they’re stored in accounts. These accounts are usually under the custody of FDIC.

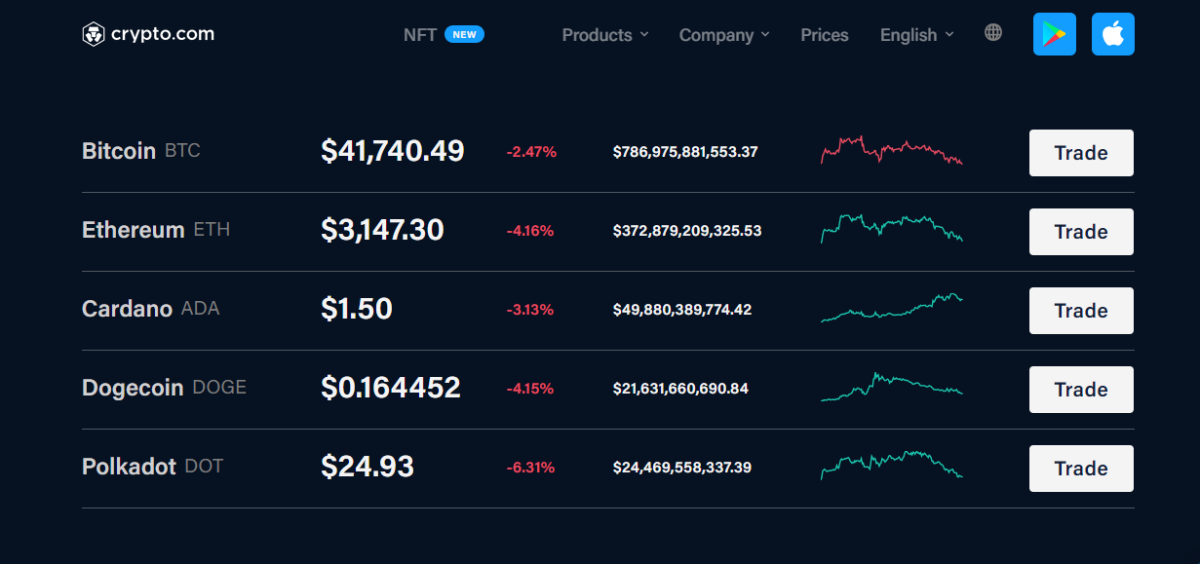

Crypto.com

Are you looking for a platform with a sheer variety of cryptocurrencies that supports mobile transactions? Crypto.com might be just the right one for you. It provides its users with nearly 180 cryptocurrencies to trade and invest in. So far, the platform has no minimum deposit, which makes it even better for beginners. Crypto.com has no transaction of trading fees. But you get to enjoy this benefit only if you transfer money from your bank through ACH. Or even through an automated clearinghouse. However, transacting with a debit or credit card can be significantly high. To save a buck, you can visit your nearest bank to carry out these transactions. Another shortfall for this platform is it doesn’t allow for crypto-to-crypto trading. For instance, if you want to exchange Ethereum for Bitcoin, you can only transact twice. First transaction is when selling Ethereum and the second is when buying Bitcoin. This feature certainly sets it apart from the other big crypto platforms.

Security

Crypto.com allows for different digital wallets if you are a trader or an investor. Also, to make it convenient, it provides you with some fantastic options for holding your crypto. One of these options is the DeFi Wallet-an app supported by blockchain technology. For security purposes, crypto.com stores most of the cryptocurrency in cold wallets. Wallets that provide offline crypto storage far from hackers’ access. Most importantly, Crypto.com provides insurance coverage in case of any losses. Crypto loses through cyberattacks or even other unpredictable incidents.

Binance

This cryptocurrency platform almost needs no introduction. It’s big, and it’s popular in the market right now. On the positive side, Binance provides users with various crypto to trade and invest in. Also, its trading fees are so much lower than most competitors. On the negative side, this platform isn’t accessible by seven states in the U.S. It has limited crypto-to-crypto trading pairs, and extra charges apply to debit and credit card users.

Security

To make it convenient for users, Binance has an official Trust Wallet for crypto storage. This wallet is a free app highly rated on the App Store and Google play store. And since the wallet is not a must-have, you can freely use another crypto wallet. In 2019, Binance reported a loss of 7000 Bitcoins, which, at that time, was worth $40 million. However, the company later fully compensated the affected users for their loss. So far, this crypto exchange has reported no other case of attack. Besides crypto security, Binance also protects deposits made in U.S dollars. This money is directly stored in bank accounts held in custody by FDIC. Even better, if your cash amount is up to $250,000, you get automatic insurance that allows for compensation in case of bank failures, theft, brokerage failure, or even unauthorized trading.

Webull

Even if it’s among some of the best platforms, it isn’t a well-versed platform for beginners. However, different from other platforms, it might have attractively low fees. Also, for investors and traders who are mobile users, Webull might be appealing to you. It has an interface that looks as slick on the phone as it looks on the desktop. In addition, its minimum deposit amount is precisely $0. When it comes to customer support, Webull doesn’t disappoint. It provides customer support both on phone and email, accessible anytime. On the downside, Webull provides extremely limited cryptocurrencies. So far, it allows 11 crypto, which makes it quite difficult if you want to diversify your portfolio. Webull charges absolutely $0 for every trade carried out on the platform. And for transactions, it charges some fee for incoming funds. Mainly, these fees apply to transactions through wire transfers.

Security

Like most platforms, Webull is also regulated by the likes of SEC and FINRA. These regulatory institutions ensure any activities run by Webull are legal and ethical.

TradeStation

As the name suggests, TradeStation embraces highly active traders. It’s a highly powered platform that makes it pretty easier for active traders to carry out their day-to-day trades. Even better, TradeStation has an impressive-looking desktop interface. This interface automatically sets the right trading mode for you. It comes with the right tools to automate, design, monitor, and test your trades. While Trading on TradeStation might cost exactly $0, the transaction fee might vary slightly. If you want to join this platform, you’d have to incur a minimum deposit of $500. Receiving funds through wire transactions costs $0. While sending wires costs $25 for equities accounts and $35 for international accounts

Security

TradeStation activities are overseen by regulatory institutions such as SEC. In addition, SIPC insures cash up to $250,000 and $500,000 for equities accounts. Therefore making it a trustworthy platform to work with.

Kraken

Kraken appeals to both new and active crypto traders and investors. Its tools are specifically made for beginners and active crypto enthusiasts. However, these advanced tools require a low fee to activate, worth paying if you want to get into the full trading mode. Moreover, Kraken customer support isn’t just average. It provides customer services all around the clock, from emails to chats to phone calls. Different from Coinbase, Kraken provides more than 90 cryptocurrencies for you to buy. And around 130 crypto-to-crypto pairs. However, if you are a Washington DC or New York resident, you can’t access the platform. Kraken has some of the lowest fees among these platforms. You also pay a processing fee if you purchase crypto through online banking/ACH.

Security

How does Kraken promise a highly safe platform to its users? By undertaking stringent security measures like storing 95% of its cryptocurrency offline in cold storage and reserving the remaining 5% in case of any withdrawal demands. Furthermore, it claims to securely store its servers in cages with around-the-clock surveillance. More importantly, it encrypts sensitive information and strictly monitors its access.

Robinhood

To sum up, on this list, we have Robinhood. For trading crypto, Robinhood offers exactly zero charges. Besides, it provides commission-free ETF, stock, and trades. And yet this platform could improve its customer support. Also, the platform has been in trouble with regulators in the past. Yet, there is a reason why Robinhood is among the best cryptocurrency platforms. Firstly, Robinhood has a remarkably easier-to-use platform to use. It’s also said to open even the most complex trading strategies to beginners. Secondly, unlike most platforms in the list, it has no minimum amount when starting. Even better, it has $0 fees for every trade carried out on the platform. Lastly, it’s one of the few platforms that allow free crypto trading.

Security

In 2020, exchange commissions and securities charged Robinhood for a data security incident. Afterward, in June 2021, Robinhood paid a penalty of $70 million. However, it is a member of SPIC and regulated by SEC. Thus cash funds up to $250,000 and Securities up to $500,000 are automatically protected.

Gate

Gate is the sixth largest crypto exchange by daily trading volume, as per CoinMartketCap. This excellent crypto exchange supports over 1400 cryptocurrencies for trading and also features its native GateToken. And as expected, you can hold the GateToken to get discounted trading fee. Besides, Gate has a peer-to-peer lending scheme to put your idle balance to work. Moreover, you can also stake crypto coins in fixed and flexible terms to earn while HODLing. Deposits at Gate won’t cost you a penny, and withdrawals are charged a fixed amount based on the coin type. Interestingly, you can leverage copy-trading at Gate to replicate successful traders by sharing 5% of the net profit.

Security

Gate deploys multiple security layers to protect its users from any unauthorized access. To begin with, it has IP monitoring, multi-factor authentication, a withdrawal whitelist, and many more security protocols in place, ensuring top-notch safety. Additionally, Gate maintains 100% collateral against the stored assets, and users can verify their individual shares from the platform. Gate has also undergone a third-party audit to validate its reserves.

Conclusion

Now that you know the best crypto platforms, you can easily choose one that works best for you. Also, remember that dealing with crypto can be risky. So you might eventually want to know more about ways of securing your crypto. Want to learn more? Here are 7 Online Cryptocurrency Courses for Beginner to Advanced Level.Want some free crypto? Here are 7 ways to earn free cryptocurrency.